Learn

Inside the Black Box of New Zealand Investment Funds

27th Sept. 2020

A recent report by Mindful Money, Inside the Black Box of New Zealand Investment Funds, shows there is $1.6 billion of KiwiSaver and retail investment funds invested in fossil fuel companies. At a time when the transition to a clean energy future is well underway, why would managers of KiwiSaver funds and retail investment funds still be heavily invested in fossil fuels? It is clearly not for financial reasons.

Article published on Business Desk, Sunday 27th September 2020

The world of investment funds management is full of surprises.

A recent report by Mindful Money, Inside the Black Box of New Zealand Investment Funds, shows there is $1.6 billion of KiwiSaver and retail investment funds invested in fossil fuel companies.

At a time when the transition to a clean energy future is well under way, why would managers of KiwiSaver funds and retail investment funds still be heavily invested in fossil fuels?

It is clearly not for financial reasons.

The value of fossil fuel companies has collapsed over the past five years.

The US Oil & Gas index has fallen by 63 percent during a period when the overall market has risen by nearly 50 percent. This represents a huge loss of value for investment funds and for their investors.

There have been ample warnings of the financial risks posed by fossil fuel investments from Mark Carney, former Bank of England governor, and others.

The odd power of inertia

Some KiwiSaver and retail investment funds have been divesting or reducing their exposure, but almost 20 percent of funds have actually increased the proportion of their portfolio in fossil fuels over the past year, even in the face of mounting financial losses.

This is out of step with the majority of customers. The public are clearly waking up to the climate crisis and want their investment to be aligned with their values. Annual surveys show three quarters of NZ investors want to avoid investing in fossil fuels. Few of these investors are aware of the scale of their losses from fossil fuel investments.

The picture that emerges is one of inertia. Most of the major investment providers in NZ have been slow to wake up to the investment revolution taking place internationally. The scale is huge - members of the Principles for Responsible Investment now have US$110 trillion of assets under management.

The growth in ethical investing has not been driven by altruism, but rather by the search for higher returns. There is ample evidence from comparative research showing the returns from ethical investment are, on average, at least as high as from traditional investing, and often higher. It is prudent and financially smart to manage environmental social and governance (ESG) risks.

There is still a challenge to make these approaches meaningful.

Lip-service vs commitment

Most investment managers claim to be ‘responsible’ but few fully integrate ESG into their portfolios and their stewardship.

Change is underway.

A number of providers, including Pathfinder/CareSaver and Simplicity, are going fossil-free and attracting new investors. Others such as AMP Capital, Booster, QuayStreet, and SuperLife have specific fossil-free socially responsible investment funds. And further offerings are on the way.

Fossil fuels are part of a wider picture of ethical investment.

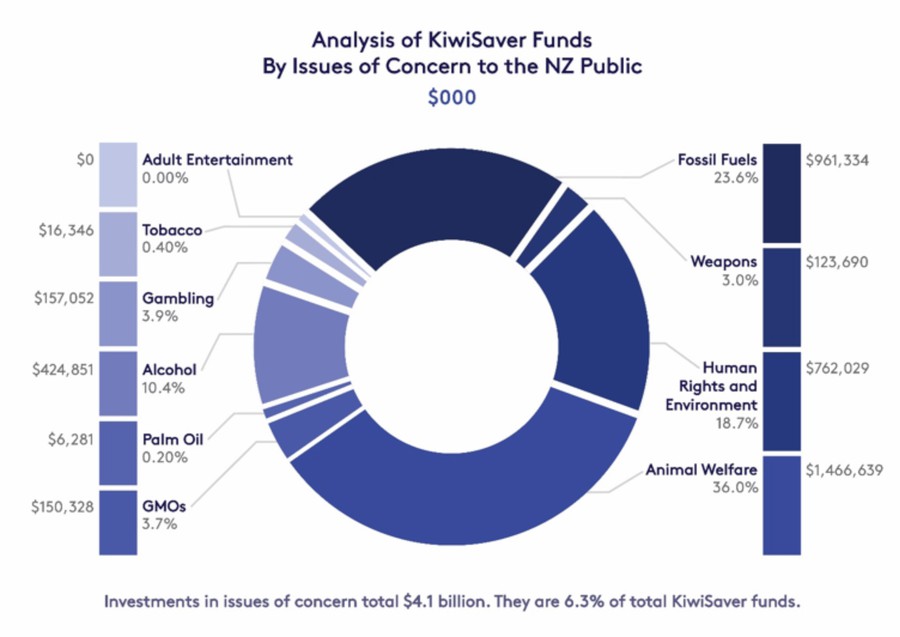

In 2016, there was a public outcry over KiwiSaver funds invested in tobacco and cluster munitions. Many funds divested but failed to take on the message that there are also other issues their customers want to avoid. These include gambling, weapons, and companies committing human rights violations.

The Black Box report shows investment in these types of companies is declining as more funds step up to reduce their holdings or divest completely.

Check your KiwiSaver

Even so, analysis of KiwiSaver portfolios shows there is still $6.4 billion invested in companies that surveys show Kiwis most want to avoid, including fossil fuels.

Investors are waking up to the realisation that they have choices. They don’t need to stay with their bank or the provider they have used for years. There are now options for them to do good while earning good returns.

Members of the public and asset owners are taking control of where their funds are invested and choosing to invest for a better future.

Barry Coates is founder and CEO of Mindful Money, a charity promoting ethical investing www.mindfulmoney.nz.