Learn

Two Years After Russia's Invasion of Ukraine: Reflecting on the Power of Ethical Investing

19th March 2024

As the saying goes, money makes the world go around. By making good money choices, we can make a better world.

Two years ago, when Putin brutally invaded Ukraine, Kiwis mobilised as part of a global movement that saw billions of dollars of investment withdrawn from the companies that finance Russia’s war.

Most Kiwis were appalled by the Russian targeting of civilians and the suffering of the Ukrainian people. But few realised that we were more than innocent bystanders.

In the immediate aftermath of the invasion, we issued a call for New Zealanders and fund managers to divest from Russian companies that were linked to the state or pivotal in funding Russia's military activities. The response from New Zealanders was immediate and profound, underscoring a universal truth – our collective voice holds immense power.

By choosing to divest, individual and institutional investors not only took a stand against aggression but also safeguarded their investments from the repercussions of global sanctions against Russia.

The call for divestment was not just a moral stance but a protective measure for investors. As predicted, investments in Russian assets suffered steep declines in value, exacerbated by international sanctions and the global community's repudiation of Russia's actions. The KiwiSaver and investment funds that were slow to divest lost almost all of the value of their shares and bonds. Those who divested early avoided significant financial losses, underscoring the alignment between ethical decision-making and prudent financial management.

It's been heartening to see the swift and decisive action taken by New Zealanders and their investment funds. Whilst the initial value of New Zealand's investments in Russia was over $100 million, within days of publicising the holdings, we can proudly say that the majority of those funds were redirected.

Investment in other conflicts

However, there are other conflicts supported by New Zealand investments. There are 88 KiwiSaver funds invested in companies that directly support the Myanmar military, despite their brutal assault on the courageous monks and civilians who are calling for a peaceful transition towards democracy.

There are also over 400 funds invested in companies illegally operating in the Palestinian Occupied Territories, despite a UN Security Council resolution that was co-sponsored by the New Zealand government. As responsible members of the global community, we should ensure that New Zealanders’ investments do not support or perpetuate violations of human rights and international law.

Where our collective KiwiSaver are invested

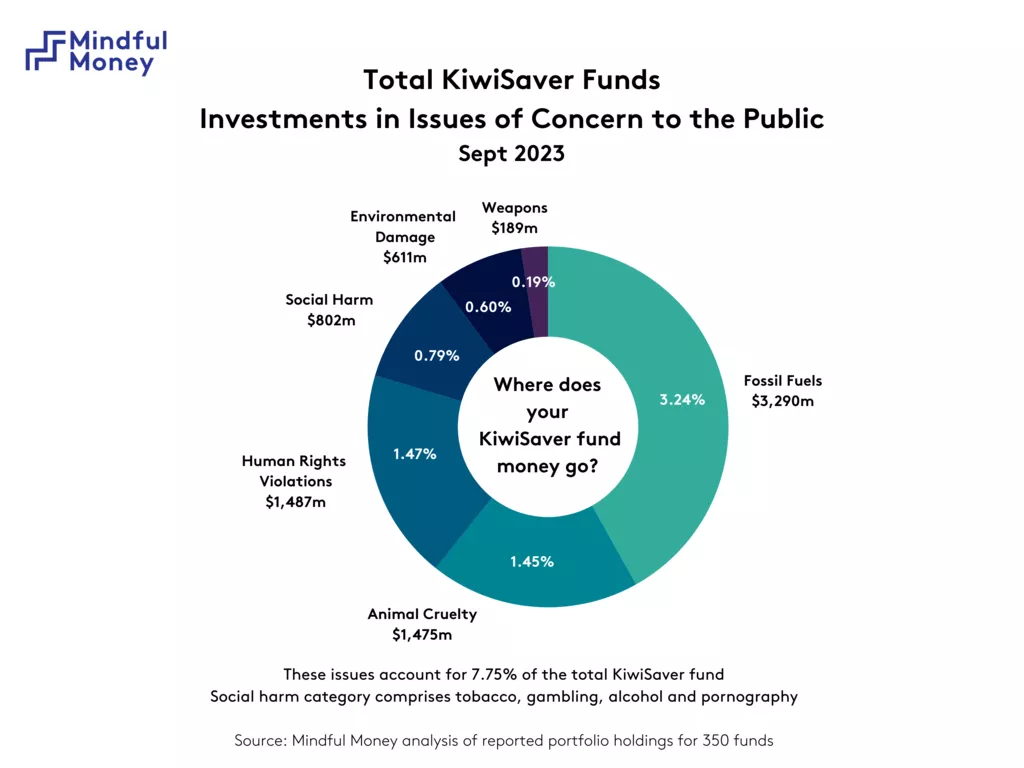

Our annual surveys consistently show that New Zealanders want to avoid investing in companies that violate human rights, practise animal cruelty, or contribute to fossil fuels, weapons, social harm, and environmental damage. Despite recent progress, there is still almost $8 billion of KiwiSaver funds invested in issues that most New Zealanders want to avoid, including $82 million in companies that are complicit in war and conflict.

Transparency has been crucial in driving change. New Zealanders can now see, for free, what companies are in their KiwiSaver fund on the Mindful Money website. This consumer power has pushed ethical and sustainable investment into the heart of our KiwiSaver and investment institutions, banks, and institutional investors like trusts and foundations, charities, unions, universities, and councils.

The next phase is even more inspiring. Smart investing also means opportunities to invest in positive outcomes for the climate, people, and the environment. The leading KiwiSaver and investment providers are starting on that journey.

At Mindful Money, we believe that investing ethically is not only a sound financial strategy but also the way that we can take responsibility for our money. We can avoid conflict and support peace around the world. And in this climate crisis, we can avoid fossil fuels and fund climate solutions. Together, we can use our money for good.

We encourage everyone with a KiwiSaver or an investment fund to visit our checker, find out what they are invested in, and engage with their fund provider over investments that they are concerned about, or find a fund that better aligns with their values.

Our actions today shape the world we live in tomorrow. We need to invest in a future that promotes peace, sustainability, and respect for human dignity. The decisions we make as investors send a powerful message about the world we want to create.

What you can do:

Spread the word. Our voices have more impact than we know - talk to your friends, family, co-workers. Everyone deserves to know what their money is getting up to when they are not looking.

Workplace or community seminars. Let us know if you have a group of people who would like to hear more about investing ethically, and our team can come and host an even, either via Zoom or in person. Get in touch with olive@mindfulmoney.nz.

Tell your provider what you want. The drastic change mentioned above shows that fund managers are listening to what New Zealanders want. We encourage you to send an email or make a phone call to your bank or fund provider and tell them what you want (and don't want) them to invest in.

Align your money with your values. Want to make the move to ensure your money is not supporting the industries that don't align with your values? You can use our Fund Finder; just input your values, and it will suggest the best Mindful Ethical KiwiSaver or Investment fund that suits.