Learn

Doing well as well as doing good

15th April 2020

It should be no surprise that sustainable business is also good business financially. Companies with a strong sustainability track record are typically well-managed. They gain advantages from a good reputation, a strong brand and loyal customers, motivated staff and no environmental liabilities.

It should be no surprise that sustainable business is also good business financially. Companies with a strong sustainability track record are typically well-managed. They gain advantages from a good reputation, a strong brand and loyal customers, motivated staff and no environmental liabilities.

Yet, until recently, the financial sector has ignored these factors when looking at company value. The social and environmental impact of the companies they invest in has been considered irrelevant. They have funded pollution and exploitation without regard to the consequences. The blindness of the financial sector to the consequences of their funding decisions has fuelled climate chaos, biodiversity loss, rising inequality and other crises.

However, it hasn’t been the moral arguments for sustainability that have finally convinced the financial sector to start listening, but the opportunity to make more money. There is now a huge body of evidence showing that investors can earn higher financial returns with less risk if they invest in businesses that reduce their environmental and social risks.

Some of this evidence relates to better resilience in a crisis. There have been recent studies by financial research companies Bloomberg, Morningstar and the Financial Times showing that international funds that manage their Environmental, Social and Governance (ESG) risks have done better in the downturn. But what about New Zealand?

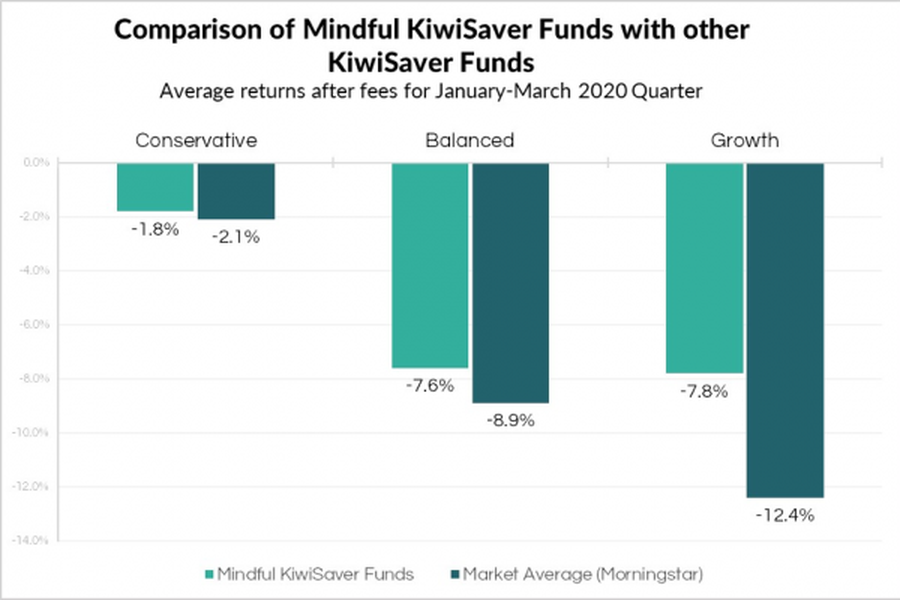

Mindful Money, a new charity promoting ethical investing, has run the numbers for KiwiSaver funds during the COVID-19 downturn. The results are consistent with international findings. The Mindful KiwiSaver funds – those that meet Mindful Money’s high ethical standards, with verified credentials – have significantly outperformed the sector average.

This is an important finding. At a time when 3 million New Zealanders with a KiwiSaver fund are seeing their hard-earned savings being eroded, they can opt for a more resilient fund. And the bonus is that they can also avoid doing harm to people and our planet and invest more in companies with high sustainability standards. That’s a classic win-win.

For example, one of the reasons the Mindful KiwiSaver funds have done well is that most have excluded all or most fossil fuel companies from their portfolio. They have avoided coal companies that have declined in value by 28% per year for the past decade, and oil and gas companies whose share prices have halved over the past five years.

It’s not that there haven’t been warnings. Calculations show that using all the fossil fuel reserves would destroy our climate, and us all. The decline of the fossil fuels sector has been repeatedly predicted by Mark Carney, the former Governor of the Bank of England and many others who have warned of the risk of stranded assets since 2015.

The surprise is that so few KiwiSaver fund managers have excluded fossil fuels. Most fund managers are keen to talk about investing ethically but slow to actually invest in better companies. Only 2% of KiwiSaver investment is in funds that have a policy to exclude fossil fuels. Most KiwiSaver investors have no idea that their hard-earned savings are being invested in companies that produce emissions and fund climate deniers. Over $1.3 billion of KiwiSaver funds are still invested in fossil fuels.

So why have so few New Zealanders invested in credible KiwiSaver funds when the data shows 83% want to invest ethically? Annual surveys undertaken by Colmar Brunton for Mindful Money and the Responsible Investment Association of Australasia highlight the barriers. The public hasn’t had access to information on what companies their KiwiSaver fund invests in, they haven’t had the time to do the research and compare across ethical funds, and they have been confused about all the ethical claims. Mindful Money was set up to overcome those barriers.

Mindful Money’s approach of radical transparency means that a website user can see what companies their KiwiSaver fund invests in, categorised by the issues that the over two thirds of the public want to avoid – fossil fuels, weapons, human rights abuses, products tested on animals, etc. The website also helps users find a fund that meets their criteria. It’s quick, easy and free to use.

The biggest problem is getting the message out. As a small charity, Mindful Money relies on word of mouth and allies to spread the word. SBN members can help.

So far, around ten SBN member companies have invited Mindful Money to do seminars for their staff (online these days) to help them understand how they can take powerful action to support sustainability. Encouraging staff to choose an ethical KiwiSaver fund helps ensure that their KiwiSaver contributions, and the employer match, align with sustainability.

Originally published by Sustainable Business Network here.